The Challenge

The client required a centralized platform to manage their microfinance credit ecosystem—including agent performance, credit disbursement, repayment tracking, defaulter monitoring, and commission insights. The main challenge was consolidating fragmented credit data and enabling real-time visibility into repayments, overdue credits, and portfolio risk while keeping the interface clean and scalable.

Scope of the Project

– Build a unified dashboard for Admins and Supervisors to monitor all credit operations.

– Provide modules to manage agents, track credit disbursements, repayments, and commissions.

– Enable defaulter identification with overdue and repayment trend tracking.

– Integrate regional and risk-based analytics to monitor performance variations.

– Design workflows for real-time monitoring and proactive intervention.

The Solution

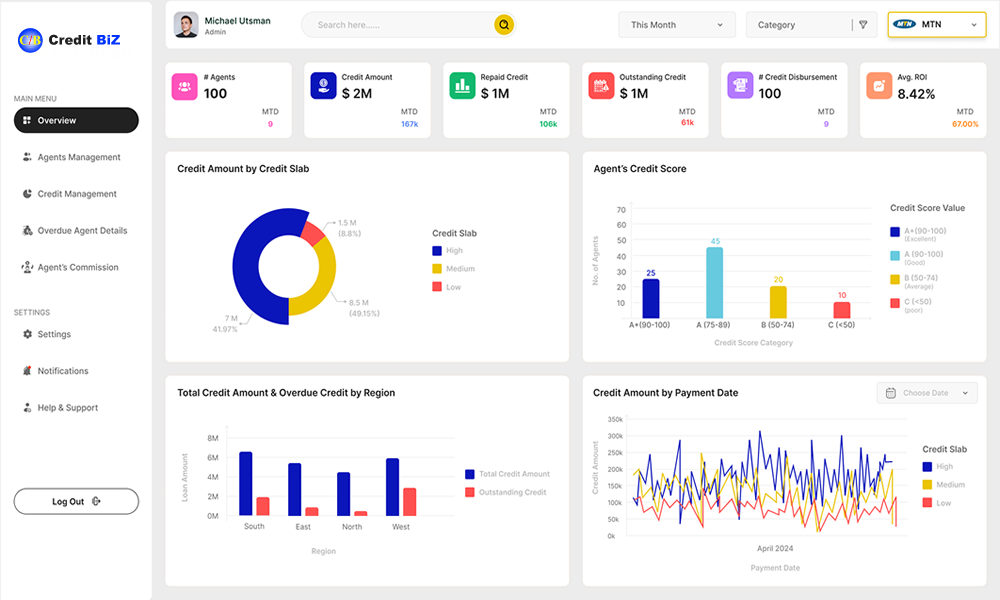

Dashboard Overview Panels

– Summary cards for Total Agents, Credit Issued, Amount Repaid, Outstanding Amount, Disbursements, and ROI.

– Color-coded indicators for MTD performance tracking.

Credit & Risk Analytics

– Donut and bar charts for credit distribution by risk slabs (High, Medium, Low).

– Time-series graphs for repayment trends and overdue amounts.

Defaulter Tracking

– Automated alerts for overdue repayments.

– Drill-down views to identify high-risk agents and borrowers.

Agent & Commission Management

– Agent scorecards with performance ratings (A+ to C).

– Commission tracking linked to disbursement and repayment success.

Regional Insights

– Maps and charts showing credit distribution and overdue patterns by region.

– Comparative analysis to identify underperforming areas.

Navigation & Workflow Enhancements

– Sidebar navigation for Credit Management, Agent Details, Defaulter List, and Reports.

– Search and filters for quick access to agent or regional data.

– Pagination and export options for handling large datasets.

Business Impact

– Improved Efficiency: Reduced manual tracking and reporting time by 40%.

– Better Risk Management: Early detection of defaulters lowered credit default rates by 25%.

– Increased Transparency: Real-time monitoring boosted trust between supervisors and agents.

– Revenue Growth: Smarter commission tracking increased agent performance and repayment rates.

– Scalability: A future-ready system that can expand with growing credit portfolios.

Technology Used

- – React.js

- – Django Rest Framework