- Products

- Product Details-Credit Management

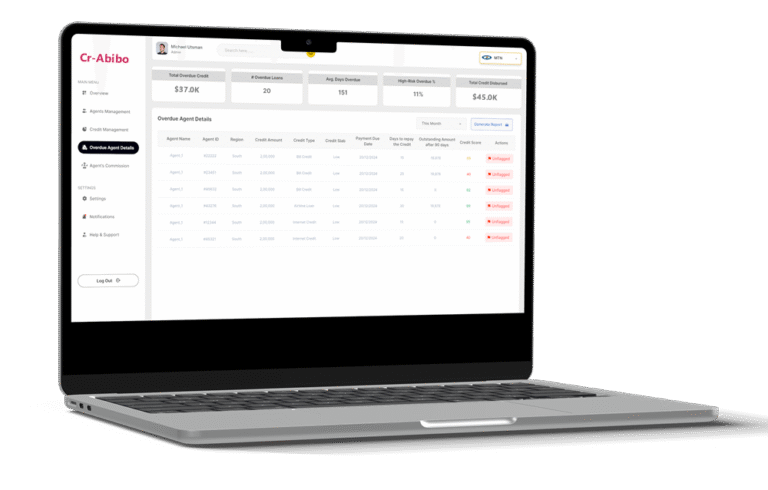

Centralized system for managing and reducing credit risks with agents.

A centralized platform that empowers businesses to monitor agent performance, manage credit limits, and mitigate financial risks across their entire agent network.

Overview

- The web portal serves as a centralized platform to track, evaluate, and manage loan disbursement and repayment behavior of field agents across various regions and telecom partners.

- Its core goal is to mitigate credit risk, enhance repayment rates, and empower finance and operations teams with real-time, actionable insights.

Credit Management

1. Unified Credit Monitoring

Track and view agent-wise credit limits, outstanding balances, and payment history in real time through a single dashboard.

2. Smart Risk Controls

Set credit limits, auto-block defaulters, and configure alerts for overdue payments to minimize financial exposure.

3. Evaluate Agent Performance

Monitor key KPIs like loan volume, repayment rates, and customer satisfaction.

Defaulter Agents

1. Pinpoint High-Risk Agents: Quickly identify agents with substantial outstanding balances

2. Visualize Repayment Trends: Assess risk through intuitive score charts and overdue duration.

Agent’s Commission Dashboard

01.

Monitor CP activations, churn, and contribution

02.

Filter by bill plan, circle, or agent name

03.

View zone performance and CP rankings.

04.

Cross-reference activation data to validate payouts.

05.

Spot Trends:

Analyze monthly sales trends at a glance.

All the reasons to choose BIITS